Introduction

Are you tired of paying high premiums and medical bills while not fully understanding your insurance policy? Well, I’m here to tell you about some options that could save money on your medical expenses and premium while also getting tax benefits. Keep reading to learn more!

What is an HSA?

An HSA is a savings account that helps you save money on healthcare costs. You can use it to pay for medical expenses like doctor visits, prescriptions, and even dental work. With an HSA, you can save money on healthcare costs, get tax savings, and have more flexibility in choosing your healthcare.

How to Qualify for an HSA

To be eligible for an HSA, you need a special type of health insurance plan called a high-deductible health plan. Not all high-deductible health plans qualify. Only specific high-deductible health plans that meet the legal criteria qualify. So, talk to an advisor to help you figure out if your plan does.

How to Open an HSA

Choosing the right HSA provider is important because it affects your costs and benefits. Once you’ve chosen a provider, opening an account is easy and can be done online or in person. You can fund your HSA through payroll deductions or individual contributions. Make sure to compare different HSA providers to find the one that suits your needs and offers competitive features.

Using Your HSA Funds

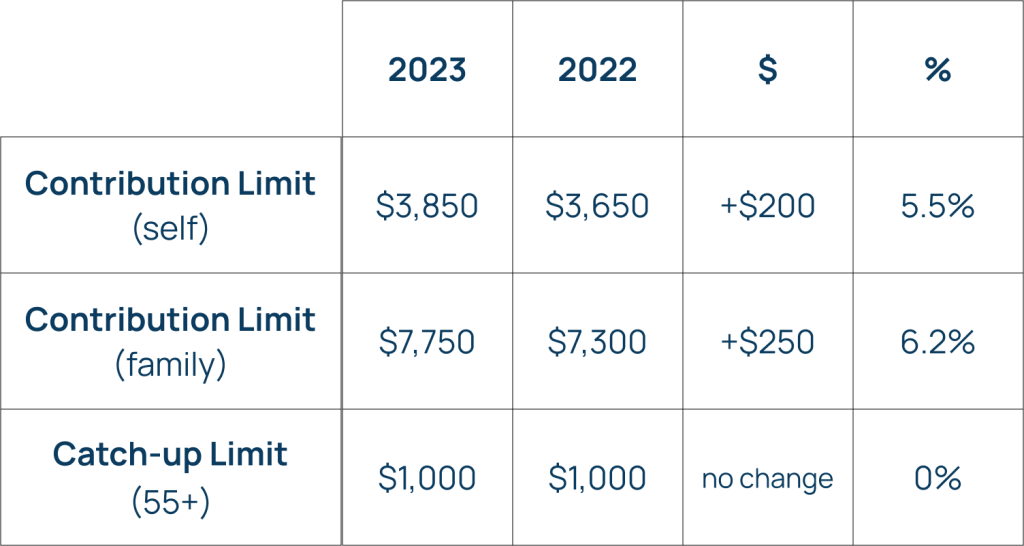

You can use your HSA funds to pay for many medical expenses, like doctor visits, prescriptions, and even some over-the-counter products. You can use your HSA funds with a debit card or reimbursement system. Keeping track of your HSA expenses is important for tax purposes and budgeting. There are also funding limits per year shown in this graph, so you need to pay attention to how much you are putting into your HSA account each year.

HSAs offer great flexibility in using your funds for a wide range of qualified medical expenses. However, it’s important to stay within the funding limits to avoid tax penalties.

Managing Your HSA

To get the most out of your HSA, you should contribute regularly, invest your funds, and use your HSA to pay for long-term healthcare costs. The rules for rollovers and tax-free withdrawals can be complicated, so it’s important to work with an expert. You should update your HSA as your health needs change to make sure you’re always covered.

Taking a proactive approach to managing your HSA can help you maximize its benefits and ensure financial security for your healthcare needs.

Conclusion

We hope this article has helped you understand the benefits of health savings accounts and how they can save you money on your medical expenses. At Compass Insurance Advisors, we believe that everyone deserves access to affordable, quality healthcare, which is why we offer a variety of insurance options from over 100 insurance companies to fit your needs. If you’re interested in learning more reach out to one of our advisors!